During his first tenure as foreign minister 2018-2020 he authored the Foreign Policy Framework of the New Malaysia which served as Malaysias key foreign policy priorities. While annual allowance is a flat rate given.

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

. The quantity rose to 38000 tons per day thirteen years later in 2018 despite the increased recycling rate of 175. For Travel Agents For issuance of proper tax invoice by IndiGo please ensure that GSTIN name of GSTIN Customer and e-mail address of the Corporate or Business Entity for whom. This is alarming as.

Malaysia follows a progressive tax rate from 0 to 28. He added that SERC also expects BNM to raise the overnight policy rate OPR by another 25 basis points bps to 25 per cent at the end of the year. Gross Total Annual Income - the long term capital gains - the short term capital gains - deductions claimed under Section 80 from the Section 80 C to the Section 80 U except the section 80 GG itself.

The waste generated in Malaysia in 2005 was 19000 tons per day at a recycling rate of 5. What is the Capital Gains Account Scheme. Dislocation Allowance DLA.

Unlike the old superdeduction scheme which only had a cash value if the company was paying corporation tax. Whichever of a b or c is less will be exempted from taxation by the income tax department. Vivid Economics predicts that allowances will go for at least 41 each nearly double the 2278 state agencies estimated in 2021.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. On average the industry pays a 45 tax rate when all state federal and foreign taxes are totaled up. With fast-growing cities and ballooning population developing countries like Malaysia are facing numerous challenges in sustainably managing wastes.

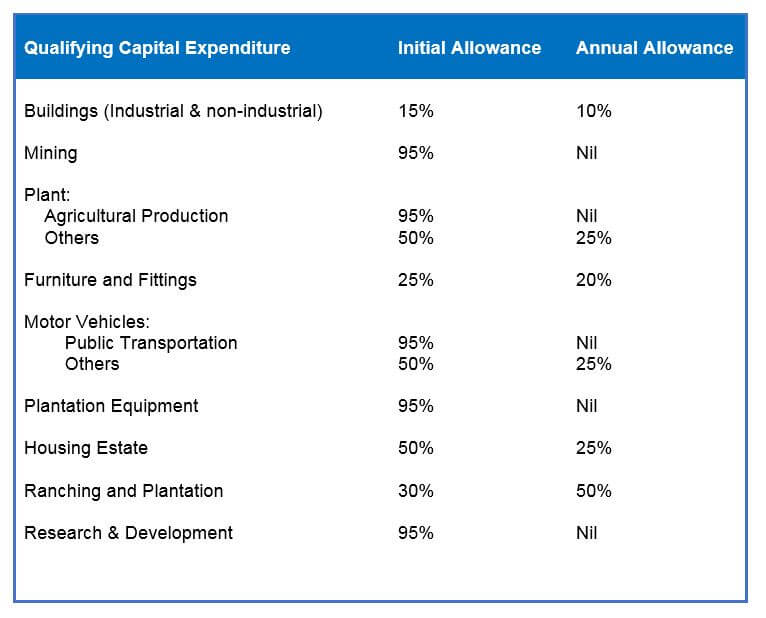

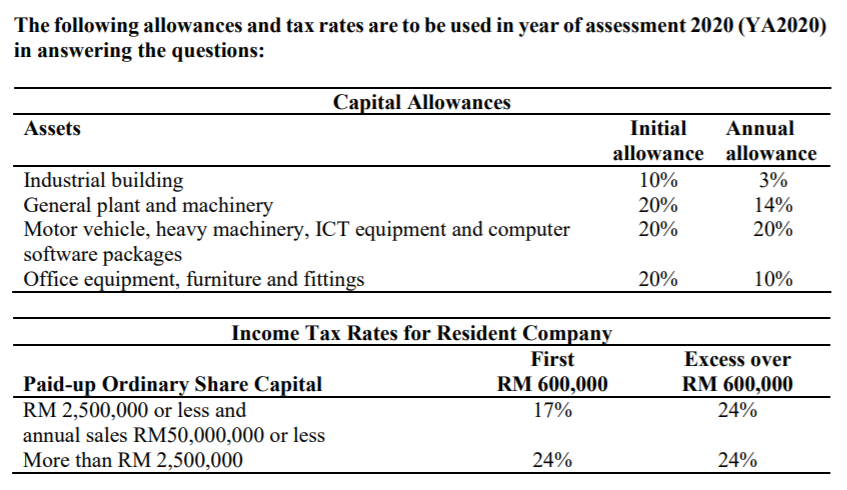

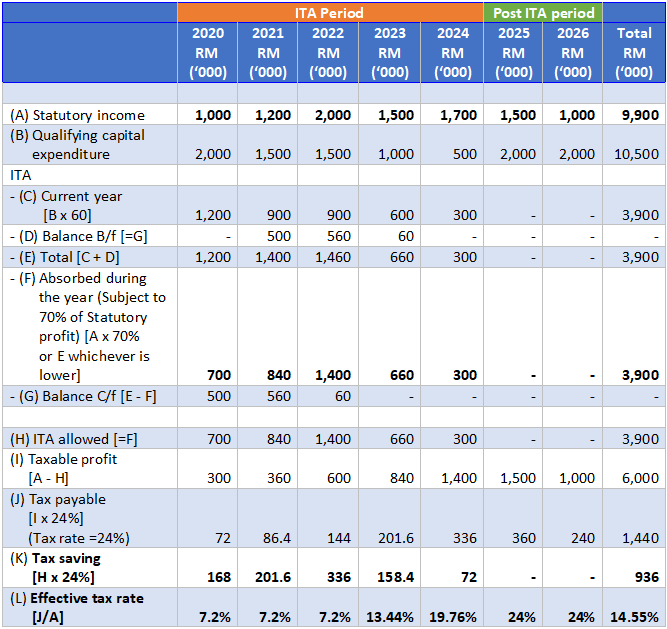

Pre-arranged fixed allowance for a personal automobile used for business purposes. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. A company granted ITA is entitled to an allowance of 60 on its qualifying capital expenditure factory plant machinery or other equipment.

Names changed the standard transliteration of the spelling of the Ukrainian capital from Kiev to Kyiv. This scheme was introduced in the year 1988 by the Central Government. The basic rate was further cut in three subsequent budgets to 29 in 1986 budget 27 in 1987 and 25 in 1988.

8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule. 72018 Date Of Publication. The parts would be expensed or capitalized as plant in service when used depending on the reporting entitys policies for components and major maintenance see UP 1223 and UP 1241.

The tax rate on capital gains from securities held in such an account is 10 after a three-year holding period and 0 after the accounts maximum five years. Subsequent governments reduced the basic rate further to the present level of 20 in 2007. KRW 1 billion or more of the threshold amount when the transfer occurs between 1 April 2020 and 31 December 2022 the capital gains are taxed at the rate of 22 to 275 if the holding period is less than one year 33 would be applied including the local.

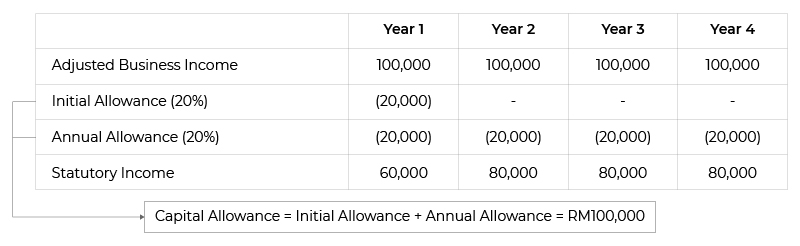

Prolonged periods of low interest rates can induce financial imbalances by reducing risk aversion of banks and other investors as well as borrowers he said. By comparison the Healthcare Industry pays a total rate of 35 and the Pharmaceuticals pay. Capital allowances consist of an initial allowance and annual allowance.

The top rate of income tax was cut to 40 in the 1988 budget. Capital spares may be classified as part of the plant balance prior to use in the plant. As mentioned in the above paragraphs the time limit provided to the depositors for re-investment and to avail the exemption in most of the cases is longer than the due date for filing the income tax returnIn these cases the taxpayers are given the choice of.

In Malaysia tax incentives both direct and indirect are provided for in the Promotion of Investments Act 1986 Income Tax Act 1967 Customs Act 1967 Excise Act 1976 and Free Zones Act 1990. From 1 January 2018 the credit rate increased to 12 from 11 providing a net cash benefit of 972 at a 19 tax rate. RDEC is payable regardless of the tax position subject to some restrictions including a cap based on PAYE and NI.

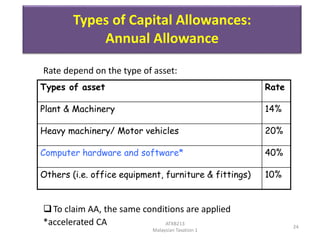

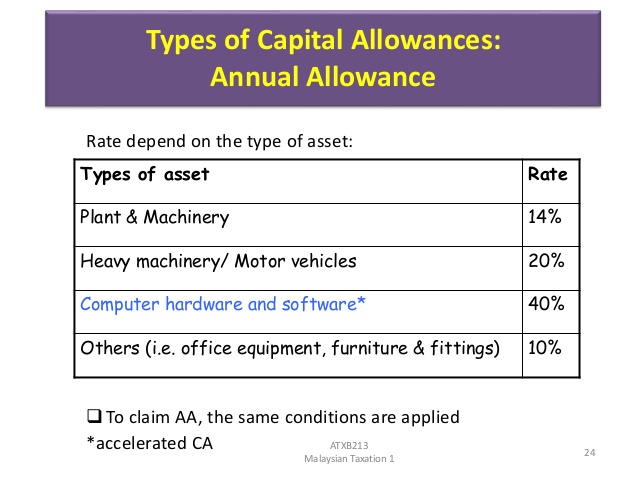

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. The fees and charges recovered for Special Service Request SSR such as excess baggage cancellation modification etc are inclusive of GST at the applicable rate. Find out the baggage policy for Malaysia Airlines including your carry-on and checked allowance plus excess baggage fees.

See how you can avoid paying fees. For a maximum per diem rate of 949 for Langkawi Malaysia from March 1 2015 through March 24 2015. The investment income surcharge was abolished in 1985.

Capital allowances consist of an initial allowance IA and annual allowance AA. Multiracial and moderate Malaysian democracy 2017. Effective November 1 2006 the Per Diem Supplement has been amended to reflect this change.

He has published eight books the latest of which is New politics 20. There is an allowance Freistellungsauftrag on capital gains income in Germany of 801 per person per year of which you do not have to be taxed if appropriate forms are completed. IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained.

Chapter 7 Capital Allowances Students

Capital Allowance Calculation Malaysia With Examples Sql Account

Capital Allowance In Nigeria Bomes Resources Consulting Brc

Capital Allowance Liberal Dictionary

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

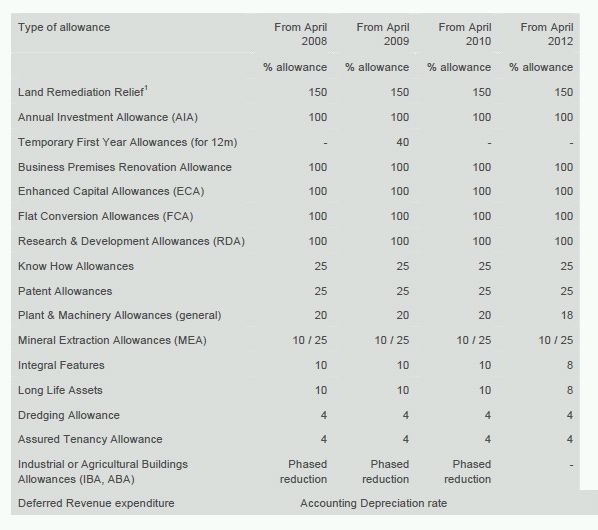

Capital Allowances Recent Changes To Rates Thresholds Etc Tax Authorities Uk

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Malaysia Taxation Junior Diary Capital Allowance Schedulers

Tax Planning For Business Assets The Star

Capital Allowance Rate Malaysia Isaiahctzx

Notes Capital Allowance Capital Allowance Capital Allowance Is A Tax Relief For A Business Who Studocu

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Malaysia Taxation Junior Diary Capital Allowance Schedulers

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

.jpg)